实验 | 使用本地大模型预测在线评论情感类别和分值

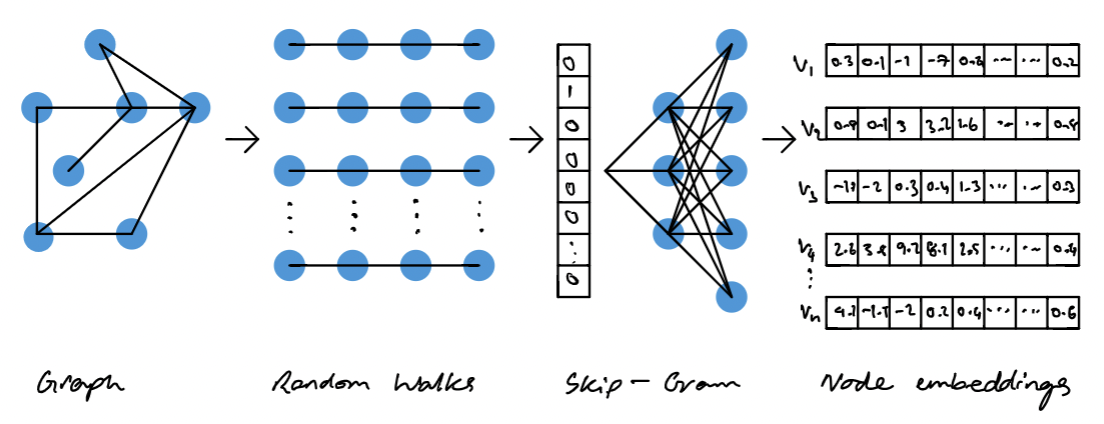

情感分析是分析文本以确定消息的情绪基调是积极、消极还是中性的过程。通过情感分析,我们可以了解文本是否表现出快乐、悲伤、愤怒等情绪。主要的计算方法有语义词典法、机器学习法、混合方法、其他方法。 随着chatGPT这类大语言模型的出现, 它们增强了文本理解能力,使我们能够更精准的把握文本中的语义和情绪,也因此大型语言模型 (LLM) 一出场就有实现情感分析功能。Sentiment analysis is the process of analyzing text to determine whether the emotional tone of a message is positive, negative, or neutral. Through sentiment analysis, we can understand whether the text expresses emotions such as happiness, sadness, anger, etc. The main computational methods are semantic dictionary method, machine learning method, hybrid method, and other methods. With the emergence of large language models such as chatGPT, they enhance text understanding capabilities, allowing us to more accurately grasp the semantics and emotions in the text. Therefore, large language models (LLMs) have implemented sentiment analysis functions as soon as they appeared....